A Closer Look at Student Loan Deferment and Forbearance

Blog Post

Feb. 26, 2015

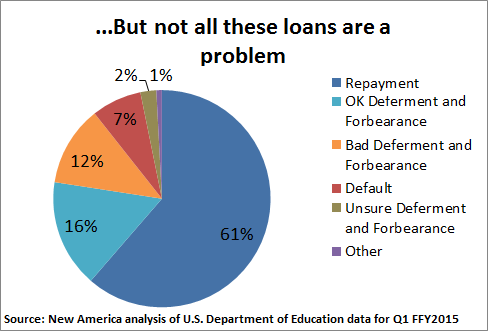

Over 30 percent federal Direct Loans that have entered repayment are in financial no-man’s land. They are not in default, nor are they in active repayment. Rather, they are in either deferment or forbearance—two options borrowers have for not making payments on their student loans without the risk of defaulting.

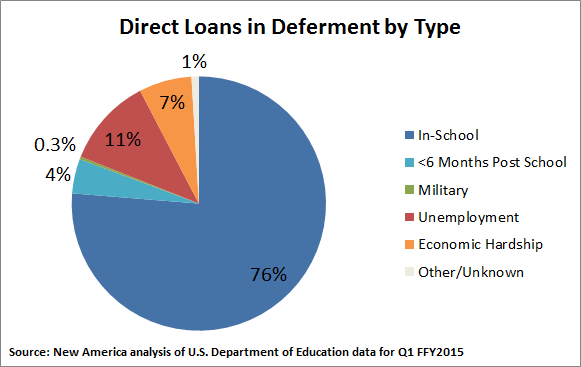

Now, for the first time the U.S. Department of Education released data that break down the type of deferment or forbearance borrowers are receiving, allowing us to better understand why approximately 6 million borrowers (some may be double-counted) are not making payments on their loans. The answer appears is not further proof of struggling students or ticking time bombs. Instead, the issue is largely due to borrowers returning to school.

In total, $173.2 billion in federal Direct Loans were in deferment or forbearance in last three months of 2014 (also known as the first quarter of the 2015 federal fiscal year). While both statuses allow a borrower to stop making payments, deferments are generally better for borrowers because interest on subsidized and Perkins loans does not accrue. By contrast, subsidized and Perkins loans in forbearance still accumulate interest. Unsubsidized and PLUS loans accumulate interest in either status.

A closer look shows that 53 percent ($91.7 billion) of Direct Loans dollars in deferment or forbearance are not being paid down for reasons that should not be a substantial concern—borrowers are back in school, have not yet returned to repayment, or are trying to qualify for income-based repayment. That said, 39 percent of these loan dollars ($68 billion) are in deferment or forbearance for reasons that should be worrying—students are experiencing an economic hardships, unemployment, etc. The remaining $13.5 billion (8 percent) is split almost equally between borrowers that are probably working toward special forgiveness options, such as those available for teachers, and loans for which there is no reported status.

This breakdown should change our understanding of the size of some student loan problems. For example, if you do not disaggregate the deferment and forbearance figures and include defaults then it looks like nearly 38 percent of Direct Loans that have entered repayment are in some kind of troubling status ($215.7 billion and approximately 8.9 million borrowers). Removing the less concerning deferment and forbearance statuses drops that figure to 19 percent of loan dollars ($110.5 billion and approximately 5 million borrowers). Having nearly one-fifth of loan dollars in a potentially bad place is still a very large problem, but it is at least half the size of what the data would initially suggest.

Deferment: mostly school-related

Being back in school is the most common reason why loans are in deferment, accounting for over 80 percent ($69.7 billion) of dollars in that status. These debts are likely from borrowers who are seeking additional credentials (such as going to graduate school or completing a bachelor’s degree after finishing an associate’s degree) or who have returned to school after dropping out. These debts should eventually enter repayment and are not a big concern.

The more troubling loans are the $15.6 billion that are in unemployment or economic hardship deferments. Borrowers can qualify for an economic hardship deferment if their monthly income is either below federal minimum wage ($1,257) or 150 percent of the poverty line based upon their family size. Borrowers may also qualify if they are receiving benefits like Temporary Assistance for Needy Families or food stamps or serving in the Peace Corps. These deferments can be granted for up to three years. These are all borrowers more likely to struggle.

In particular, the $5.8 billion in economic hardship deferments should be prime targets for income-based repayment outreach efforts since they are almost certainly in a situation where their earnings are low enough to see a payment reduction.

Forbearance: where the greater problems lie

Administrative forbearances are the second most common type at $21.7 billion. These can be thought of as borrowers that are in the process of addressing their debt burdens, most likely because they are in applying for an income-based payment plan or some other benefit and are still dealing with the paperwork. These loans should not be too big of a concern, assuming borrowers can stay in the programs they are attempting to enter.The $86.7 billion in forbearance is a bit harder to parse. That’s because the rules around obtaining forbearances are not quite as strict. For example, $52.4 billion of loans are in what’s known as a discretionary forbearance—when the servicer chooses to grant a forbearance based upon things like economic struggles or an illness. This is a pool of borrowers that clearly feels unable to repay at the moment, but we have no idea why they are in that situation. This is a pool of loans we should be most concerned about because it is the quickest and most readily available solution for struggling borrowers.

Another $6.4 billion is in what’s known as mandatory forbearance. These are forbearances that must be granted by the servicer and as such are governed by stricter eligibility rules than the discretionary forbearances. This includes borrowers who are waiting to qualify for teacher loan forgiveness, students getting national service awards like Americorps, or assistance from the Department of Defense or National Guard. It also might include people who have debt burdens above 20 percent of their monthly pre-tax income.

A short- or long-term problem?

Even with the new data there’s still a big problem: we have no idea why borrowers are using some types of deferment and forbearance. For example, it is not that troubling if the $52.4 billion in discretionary forbearances is largely comprised of a revolving pool of borrowers who need help for just a few months and then start repaying their loans and are then replaced by other individuals. In that case, deferments and forbearances would be temporary safety nets.But if borrowers in some types of deferment or forbearance are the same year after year, then we should be worried. In that case, the individuals will see their balances balloon through interest accumulation. And they won’t be working toward any loan forgiveness the way they would in an income-based payment plan. Those borrowers may have solved their short-term problem of monthly payments, but are likely digging a deeper hole that will be nearly impossible to climb out of over the long run.

These new data show that the deferment and forbearance problem is clearly not as big as we might have thought previously. But the overall number of people delaying their loan payments is still very high. If most of the roughly 5 million borrowers in this position are just using these options for a few months to get back on their feet, then there’s little to worry about. But if this is just a long slow interest accumulating road to default, then there is still a large problem to solve."