Why U.S. Withdrawal from the Paris Agreement Might Be Good News for the Global South

Blog Post

Shutterstock

Sept. 23, 2025

This article is part of the Power Switch series, which explores the need for systemic changes to critical minerals production, geopolitics, and climate finance to empower the Global South in the clean energy transition.

At a Glance:

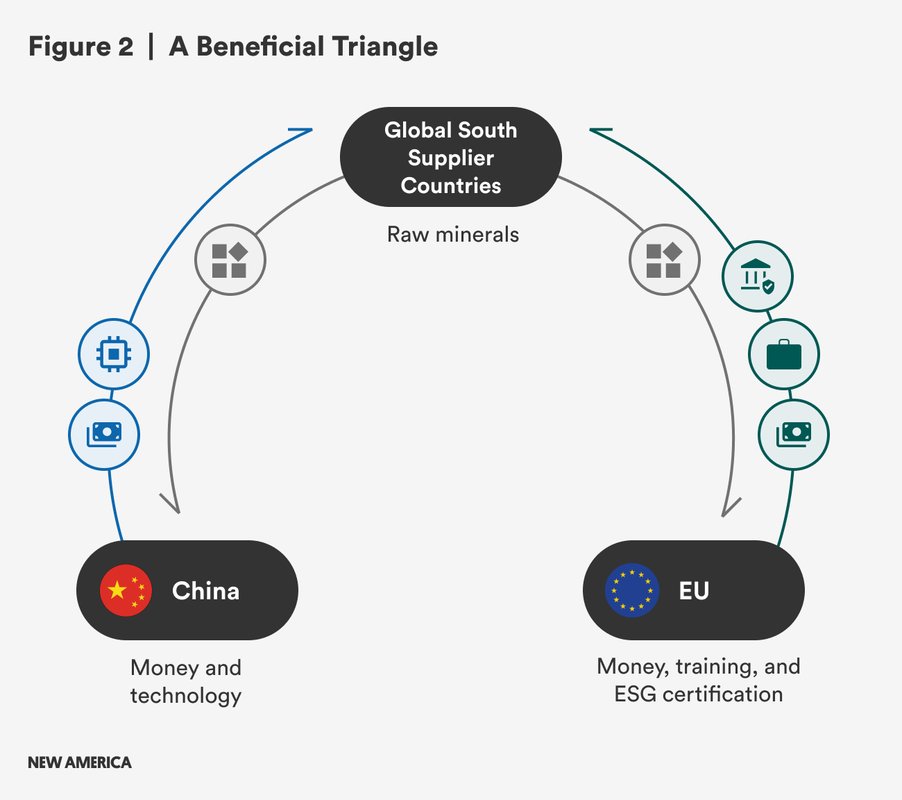

● In the wake of the U.S. withdrawal from the Paris Agreement, China and the EU are competing for climate leadership and partnerships in the Global South with infrastructure initiatives, investments, and development finance.

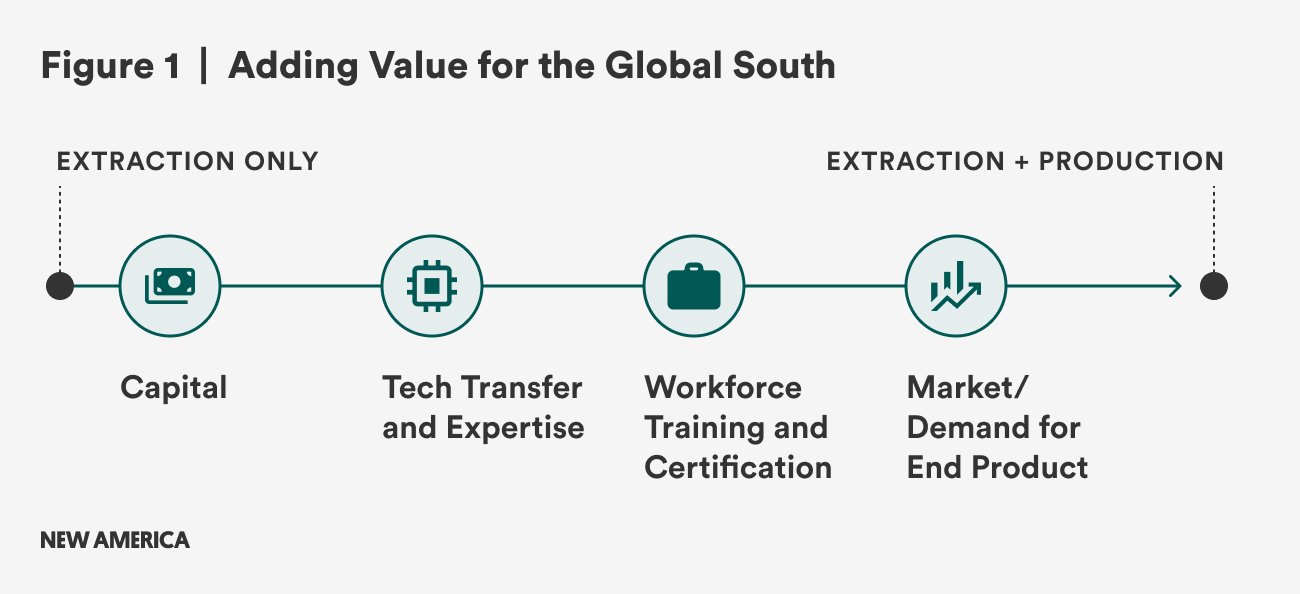

● Global South countries can leverage this great power competition to move beyond exporting raw materials and shape partnerships that prioritize industrial development, tech transfer, and value creation.

● Global South countries are negotiating bilateral, sector-specific agreements—what we call mini trade deals—in months instead of years with China and the EU to include tech transfer and support industrial upgrading, workforce development, and value-added production. Indonesia, Morocco, and Rwanda show how targeted policy and investment can expand domestic capacity.

● Bilateral agreements, though nimble, can only go so far. To support inclusive green industrialization, the Group of 20 (G20) and other global forums have an essential role to play in aligning trade and finance frameworks and linking Global South production with Chinese tech and European financing.

● A new global bargain on climate-aligned industrial development must deliver predictability and equity backed by concrete mechanisms for tech transfer, investment coordination, and supply chain resilience.

When the Trump administration withdrew from the Paris Agreement in 2025, many feared the move would undermine global momentum on climate action. Instead, it signaled a broader American retreat from climate leadership that created something unexpected: space for new forms of multilateral cooperation that could fundamentally reshape how countries in the Global South engage with the green energy transition. The U.S. withdrawal wasn’t just about emissions commitments, but represented a step back from driving global climate policy across all dimensions, including the trade, finance, and tech transfer mechanisms that support decarbonization.

This broad disengagement left China and the EU to compete directly for climate leadership and partnerships in the Global South, independent of American preferences about how climate action should work. Within the Paris framework, the United States had consistently prioritized market mechanisms and intellectual property protections that often limited tech transfer, particularly to Global South countries. Absent American leadership, China could offer more generous tech-sharing arrangements and the EU could focus on industrial policy support and long-term partnerships that might have conflicted with U.S. strategic interests.

This shift arrives at a critical moment. Recent climate change studies suggest that the world is likely to lock in the Paris threshold of 1.5 degrees Celsius in warming over pre-industrial levels, triggering severe and irreversible impacts on ecosystems, economies, and human health. To avoid exceeding this and other climate and emissions targets, the global economy needs to redirect more than $4.5 trillion annually toward clean energy infrastructure by 2030. A substantial part of the decarbonization process will entail adding more energy from renewable sources and shifting to battery-powered industry and transportation. Yet current trade patterns risk trapping Global South countries in the same extractive relationships they’ve inhabited for decades.

The vast majority of critical minerals required for this historic reindustrialization of the global economy—lithium, cobalt, nickel, and an array of rare earth commodities—lies in reserves in Africa, Latin America, and Asia. This sets up a conundrum that echoes the oil age, when control over extraction, refining, and trade routes became levers of global power that defined an era of imperial expansion and entrenched inequality between highly industrialized and developing nations. The legacy of that era brings the challenge of the next energy transition into sharp relief. Africa, for example, holds 30 percent of global mineral reserves critical for clean energy, but processes less than 10 percent domestically. Without strategic intervention, the green energy transition will simply reproduce colonial-era economic structures with new materials.

Source: Alex Briñas

The disruption of American climate leadership has opened pathways for mini trade deals that can transform this dynamic. These smaller, industry-specific agreements focus on particular sectors or supply chains rather than comprehensive market access; they can be negotiated in months instead of years; and they can explicitly include tech transfer and industrial development provisions. Unlike earlier initiatives such as China’s Belt and Road Initiative, which raised concerns about debt sustainability and transparency, these mini deals offer a more flexible and targeted approach that allows countries to negotiate terms with clearer development outcomes. For Global South countries that control critical resources and offer growing labor markets and industrial hubs, this represents an unprecedented opportunity to leverage China–EU competition for climate partnerships and capture value rather than simply supplying raw materials.

The Benefits of Mini Trade Deals

This new dynamic in global climate policy has coincided with strategic pressures that make Global South partnerships more attractive to the EU and China. China’s renewable energy sector developed significant overcapacity by 2018, with solar panel production exceeding global demand by 40 percent, according to the International Energy Agency. This created strong incentives to expand overseas partnerships and manufacturing arrangements. Meanwhile, the EU’s 2019 European Green Deal and subsequent supply chain vulnerabilities exposed by the COVID-19 pandemic highlighted the need to diversify away from single-source dependencies, particularly in critical minerals and clean tech components.

In response, both China and the EU introduced major infrastructure initiatives aimed at deepening their influence in the Global South. China scaled up its Belt and Road Initiative (BRI), with BRI-linked use of clean energy and hydropower reaching $9.5 billion in 2023 alone. The EU launched its Global Gateway in 2021 as a direct counterweight, framing the initiative around transparency, democratic values, and sustainability, and pledging €300 billion in infrastructure investments through 2027. Since then, China–EU competition has intensified through parallel investment offers, overlapping development finance, and rival infrastructure partnerships across Africa, Southeast Asia, and Latin America.

More significantly, both the EU and China began pursuing what we term mini trade deals: smaller, sector-specific agreements that could be negotiated faster than comprehensive pacts and that offer more flexibility for industrial policy integration. These partnerships emerged outside traditional multilateral frameworks, enabling Global South countries to leverage competition between major powers in ways that were less accessible when the U.S., China, and the EU coordinated more closely on climate issues.

Strategic Shifts from Indonesia to Morocco

Indonesia’s strategic pivot demonstrates both the potential and challenges of leveraging these partnerships for industrial upgrading. Historically, Indonesia exported raw nickel ore primarily to China for steel production. In 2020, the government banned raw nickel exports and required foreign investors to build smelting and refining facilities domestically as a condition of market access.

The move triggered new investment from major Chinese firms such as Tsingshan Group and Contemporary Amperex Technology Co., Limited (CATL). These companies entered into sector-specific trade and investment agreements focused on building battery and stainless steel supply chains in Indonesia. As a result, the country began to move beyond extraction and build domestic capacity in midstream manufacturing.

These sector-specific arrangements are starting to show results. Indonesia’s refined nickel production more than doubled from 0.8 million tons in 2019 to over 1.6 million tons in 2023, while the nickel processing industry has created approximately 200,000 jobs. However, much of this expansion has focused on stainless steel production rather than higher-value battery components. The country is still working to redirect a larger share toward battery manufacturing, which would capture significantly more value per ton and position Indonesia more strategically in the electric vehicle supply chain.

The shift has also come at a steep environmental and human cost. Intensive mineral processing has led to deforestation, water pollution, and carbon-intensive energy use in nickel smelters, many of which are powered by coal. Spikes in respiratory disease rates and labor abuses have been documented in some industrial zones, with reports of poor workplace safety and limited protections.

Morocco provides a different model, demonstrating that countries do not necessarily need extensive mineral resources to benefit from mini trade deals. The North African country leveraged its proximity to Europe, political stability, and growing renewable energy capacity to position itself as a regional hub for clean tech manufacturing. Meanwhile, Moroccan policymakers prioritized infrastructure and regulatory reforms to attract foreign direct investment to sectors aligned with the green transition. In 2024, the Moroccan government signed a deal for a $1.3 billion gigafactory near Kenitra, signaling a clear alignment between national policy and industrial investment priorities

Morocco’s approach seems to be working: Major companies such as China’s GOTION High-Tech have committed to building battery production facilities, while automakers like the multinational Stellantis have expanded their assembly operations in the country. These partnerships have helped Morocco become the largest automotive producer in Africa, manufacturing more than 700,000 vehicles a year. The country’s successes contrast sharply with traditional development approaches that require broad economic reforms before sector-specific support or comprehensive trade agreements that take years to negotiate. Mini trade deals succeed because they allow countries to tap otherwise scarce capital investment, build expertise in specific sectors before expanding, provide immediate economic benefits that create political support, and enable learning-by-doing rather than requiring comprehensive institutional changes up front. Such deals also reorient value chains, correcting longstanding imbalances between capital-rich countries and their developing counterparts.

The challenge now is to scale these bilateral successes to support broader industrial transformation across the Global South. Individual mini trade deals, while valuable, remain vulnerable to changing political priorities, market volatility, and the unequal bargaining power of large and small economies.

A Role for Multilateral Institutions

Multilateral institutions can build a framework that harnesses the flexibility and speed of bilateral arrangements while providing predictability and coordination. This is particularly important for ensuring that the shift to clean energy creates decent work and inclusive development, and for strengthening the Global Stocktake process under the Paris Agreement, which must track industrial development outcomes alongside emissions reductions.

The G20, United Nations Climate Change Conference (COP30), OECD, and World Economic Forum, with their smaller memberships and economic focus, offer particular advantages over the UN climate process for trade–industrial coordination. The OECD’s expertise in trade policy and investment frameworks complements the G20’s broader economic coordination capacity. Under South Africa’s 2024 presidency, the G20 Trade and Investment Working Group explicitly prioritized inclusive green industrialization, calling for a “grand bargain” to support value addition at source and resilient supply chains. This mandate creates space to embed mini trade deals within a larger, predictable framework that aligns with G20 principles of development and industrial policy. The OECD’s role is critical given its established mechanisms for coordinating economic policy across diverse economies. Its Guidelines for Multinational Enterprises and Due Diligence Guidance for Responsible Supply Chains provide frameworks that can be adapted for climate–industrial partnerships. The OECD’s Development Assistance Committee also offers pathways for aligning traditional development finance with new industrial partnership models, ensuring that mini trade deals complement rather than compete with existing aid.

The G20 can provide several critical functions that individual partnerships cannot achieve alone. Coordinated demand signaling through synchronized projections of critical mineral needs gives Global South countries the predictability required for industrial investment decisions. Shared risk management approaches, including common standards for political risk insurance and currency stability mechanisms, reduce the transaction costs that often make smaller-scale partnerships unviable. Perhaps most importantly, the G20 can establish common technical standards that enable partnerships to scale across regions without requiring separate compliance regimes for each agreement.

Three-Way Cooperation

The most promising institutional model involves systematic trilateral cooperation linking Global South production capacity with Chinese tech and European financing and standards. Although the challenges to such close collaboration are significant, it would make the most of each region’s advantages while giving Global South countries multiple leverage points in negotiations. China could bring manufacturing tech, production expertise, and affordable equipment, while the EU could offer advanced environmental and labor standards, workforce training programs, market access, and development finance. Global South countries would contribute essential resources, growing labor markets, strategic geographic positions, and increasingly important domestic and regional markets.

Source: Alex Briñas

Rwanda’s emerging battery manufacturing sector illustrates this trilateral approach. Capitalizing on its classification as a least-developed country to gain duty-free access to EU markets through the Everything But Arms (EBA) scheme, Rwanda has enhanced its value proposition by exporting critical minerals. Meanwhile, Chinese electric vehicle and battery manufacturer BYD partnered with Ampersand Rwanda in 2024 to build tens of thousands of electric motorcycles, bringing Chinese tech and manufacturing capacity into the domestic market. The arrangement serves both domestic electrification goals and regional market development, while meeting European technical and environmental standards. This model deepens stakeholders’ interest in partnership success and provides Global South countries with alternatives if any single partner becomes unreliable.

Success requires institutional mechanisms that can systematically match projects with appropriate partners, coordinate risk assessments across national and multilateral agencies, and ensure that partnerships meet evolving environmental and labor standards. A Green Industrial Cooperation Platform could help overcome fragmentation by coordinating trade, investment, and tech flows across key stakeholders. Housed within G20 and OECD structures, the platform would build strong partnerships with private companies, development finance institutions, and sovereign wealth funds.

The platform would also need to navigate the diverse institutional cultures and priorities of Chinese state-owned enterprises, European multinational corporations, and Global South government agencies, while ensuring that partnerships yield genuine development outcomes rather than simply replicating timeworn extraction patterns. This requires sophisticated project design that builds in tech transfer requirements, local content commitments, and workforce development programs from the initial negotiation phase instead of treating them as add-on components.

From Extractivism to Partnerships

A climate-aligned trade and investment framework, grounded in cooperation between China, the EU, and Global South countries, would not only accelerate a just energy transition but also ensure that the Global Stocktake process measures progress in both emissions reductions and equitable industrial outcomes.

Anchoring this framework within the G20 offers the most strategic path forward. The organization combines economic weight with a smaller membership than UN climate processes, making it a more practical venue for negotiating the trade and investment components of the energy transition. A Green Industrialization Agreement, advanced through the G20, can set clear expectations for tech transfer, workforce development, and industrial policy alignment. To implement this framework, the G20 should establish a Green Industrial Cooperation Platform with a permanent secretariat, regional hubs in key Global South economies, and specialized teams focused on sectors such as critical minerals and clean energy manufacturing. The platform would serve as a matchmaking mechanism, connecting public and private investment with tech providers and local industrial strategies.

At the same time, the G20 should coordinate demand forecasts for critical minerals, support efforts to stabilize prices, and develop shared political risk insurance instruments. These tools would reduce uncertainty, encourage investment in processing and manufacturing, and help Global South countries move up the value chain. Together, these actions can replace extractive economic relationships with collaborative, climate-aligned industrial partnerships.