Preservation and Wealth-Building: Insights from Senior Homeowners in Chicago’s Englewood Neighborhood

Brief

Meegan Dugan Adell/New America Chicago

Oct. 31, 2025

Introduction

This past spring, New America Chicago’s CivicSpace initiative and the Future of Land and Housing program engaged residents in community-driven research in the Englewood neighborhood to help inform The Chicago Community Trust’s Stay in Place strategy.

Chicago’s housing challenges disproportionately affect seniors and low- to moderate-income households, especially within communities of color. Rising property taxes, deferred home maintenance, and the risk of displacement from the rising tide of institutional investors and gentrification threaten the ability of many vulnerable homeowners to stay in their homes. If Chicago hopes to close the racial and ethnic homeownership gap and make meaningful progress toward building intergenerational wealth for low-income communities, it must focus on retaining ownership and building the value of homes owned by families of color.

The Englewood neighborhood, located on Chicago’s South Side, has experienced dramatic transformations throughout its history. Originally an oak forest filled with swampland, it became a bustling site for commerce by the 1920s, as home to the second busiest shopping district in the city. However, housing stock began to age and decline by the 1940s, and the material shortage during World War II, combined with discriminatory redlining and disinvestment practices, prevented recovery. Housing stock in the neighborhood took a major hit with the construction of the Dan Ryan Expressway, followed by patterns of housing abandonment and deterioration.

The neighborhood also saw a drastic change in the population over the course of just one generation. In the 1940s African Americans were just 2 percent of the Englewood population, a figure that rose to 11 percent in 1950, 69 percent in 1960, and 96 percent by 1970, driven by white flight.

Today, the neighborhood has a population of about 21,400 residents, 88 percent of whom identify as Black, according to Chicago Metropolitan Agency for Planning (CMAP) data. After decades of discriminatory public policy and limited financial institutional investment in the community, nearly one-third of the housing units in Englewood are vacant, and almost half of residents earn less than $25,000 a year. For Englewood to achieve a new era of renaissance, it needs significant investment and support for those already in the community to maintain their homes and build value over time.

Note: Throughout this brief, quotes from Stay in Place session participants are included to highlight residents’ lived experiences and perspectives in their own words.

A companion brief on Chicago’s Pilsen neighborhood and the unique challenges two- to four-unit building owners face to retain their buildings and maintain affordable housing is available here.

Session Insights and Learnings

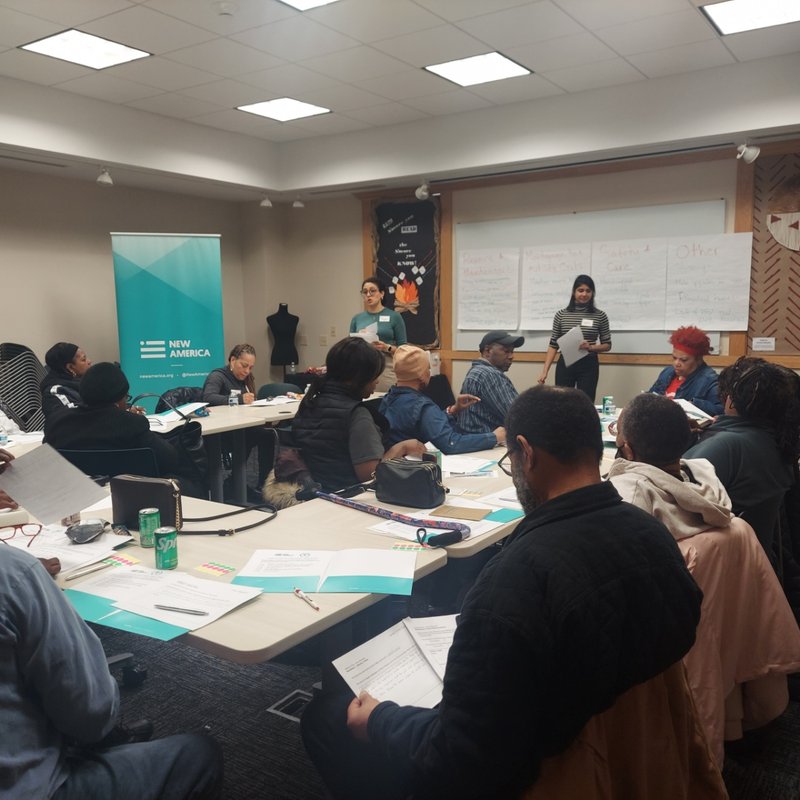

Englewood community members participate in a design session activity with Meegan Dugan Adell and Sabiha Zainulbhai from New America.

Source: Yuliya Panfil/New America

The purpose of the Englewood Stay in Place session was to better understand older adults’ needs for staying in their homes as they age, from undertaking home repairs to passing their homes to their children. The session included 17 older, African American participants from the Englewood neighborhood.

The session explored the following research questions:

- What are the biggest barriers seniors in Englewood are facing to be able to stay in the homes they own?

- What are the biggest barriers for seniors in passing their property on to their heirs? What might make it difficult for their heirs to benefit from the equity or value of the home?

- What types of repairs do Englewood seniors need the most to be able to stay in their home or ensure it has the most value when they sell or pass it on?

- How have Englewood residents navigated these challenges to date? What other resources or help do they need?

Below is a summary of key insights and themes.

Biggest Challenges to Staying in Place

The wish to stay in place for Englewood community members is strong: Nearly all participants want to stay in their homes indefinitely, or for at least the next 15 to 30 years. Several participants grew up in the homes they now live in, and raised their children and grandchildren there, too. Having inherited their homes from their parents, many participants expressed a deep sense of pride in ownership and of the family legacy and connection that their homes have come to represent: “[My home] is generational. I was raised there, my children have been raised there, and now my grandchildren.”

However, participants expressed several barriers to staying in place. These include:

- Repairs, repairs, repairs: According to nearly 88 percent of participants, the most common barrier is the cost and maintenance of current and future repairs, especially on fixed or limited incomes. Many times the need for repair caused a sense of overwhelm exacerbated by years of deferred maintenance on inherited homes. Challenges finding reputable contractors and the dearth of assistance available in paying for repairs also added to the sense of overwhelm. As one participant shared with us: “My biggest challenge is being on a fixed income and having [enough] to cover the day to day and the month to month, but not the long-range issues in terms of maintenance or repairs.”

- Unpredictable hikes in property taxes, insurance payments, and utility costs: Participants found another big barrier to be the expensive, unpredictable, and unsustainable costs of homeownership, especially given the lack of subsidies or financial assistance available. Some participants described the financial pressures as especially acute: “I have a 2-flat, but my insurance was almost $3,000, and they were going to go up to $6,000. I can’t afford this. My last insurance increased by $1,600.”

- Lack of responsiveness, limited communication of expectations, and unpredictability of nonprofit or city resources: Many participants felt like getting support was like a “roll of the dice”: unpredictable and frustrating. While a few participants did receive support from nonprofits, several did not hear back about their inquiries, couldn’t attend in person during limited hours, or did not know about these resources. There was a perception overall that there are limited resources and expert guidance available.

Additional barriers to staying in place include concerns around neighborhood safety, the prevalence of abandoned buildings in the community, and the need to make homes handicap accessible as they age.

Passing Homes to the Next Generation

Passing on homes to their children or other family members is very important to the vast majority of Englewood seniors we spoke with. However, taking ownership of these homes—while still important to most—was not as important to the next generation. About 25 percent of seniors felt their children were not interested in taking over their home.

But even if it was of interest to seniors, many still had concerns that their family would not be able to maintain the home, agree on what to do with the home, or handle the financial responsibility.

While knowledge levels differed, most participants knew some key elements of what they needed to do in order to leave the house to their children without any legal complications. However, everyone was in different places. A few were further along in the process because of helpful community resources, while others had health scares or death in the family that had gotten them started. Some common blockers arose from the group discussion and are highlighted below.

- The most common blocker among all participants was the lack of time and energy to move forward with planning. Participants knew it was important, but had trouble getting themselves to take the time to work on the paperwork and planning required. In some cases, they struggled to figure out how to talk about the difficult subjects of death and finances with reluctant heirs or negotiate different children’s expectations.

- For those who had not gotten as far along in planning, lacking enough knowledge and information, on how to get started and existing resources (notably about the legal process), was a major barrier.

- For those further along in planning, concerns about the financial costs involved (e.g., setting up a trust) and fears of scams were more common. Participants seemed to indicate a lack of authority or centralized place to obtain information.

Despite the challenges, participants also identified a few things that had already helped them or would be helpful in the future: clear instructions on what steps to take and when; online information about how to protect their assets; resources from a reputable community organization such as free legal assistance in the community; and motivating events with peers such as fun, hands-on, in-person community workshops.

One session participant shared what they found most helpful: “I learned a lot [from the workshops]... It’s good to inform the people of what they don’t know so they can take advantage of situations like this. So many homes are left to [families] that don’t know about this or that. So since we have programs like this to educate us…Opportunities like this are a blessing.”

The Perpetual Struggle of Home Repairs

The housing stock in Englewood has a rich, deep history, but most homes are older and may have experienced years or even decades of deferred maintenance. External structural repairs were most needed among participants with over half needing work on porches or new windows and nearly half needing new roofs. Electrical and plumbing followed behind.

As discussed earlier, continuous maintenance and structural issues that are very expensive, especially on a fixed or limited income, and a lack of reputable and high-quality contractors, are major challenges to staying in place. The cumulative and compounding impact of home repairs, along with the rising cost of insurance, is overwhelming for Englewood seniors, both logistically and financially.

Additional resources and guidance would help these seniors, but unfortunately, many found that home repair help is like the lottery. They didn’t know what to expect, who to trust, and there wasn’t always enough assistance for everyone. Some insights on the type of assistance the seniors received versus the actual type of guidance they would like to receive are listed below.

- One need was for trustworthy advice on what to fix first. A few mentioned that they had gotten something fixed but found problems later because of the order of repairs.

- Everyone had varied experiences with different home repair assistance programs. Some had excellent experiences. However, there was a sense of scarcity and some programs were difficult to apply for based on their schedule or process. It was not uncommon for participants to have applied for a program and never hear anything back acknowledging their application.

- A little over half of participants said they would go to a trusted local nonprofit for repair assistance, less than a fourth would go to a government program, and the same amount would go to friends or family.

Recommendations for Helping Seniors Stay in Place

The insights from the session with seniors in Englewood informed the following recommendations to help seniors stay in place and keep their homes within their families. These are for nonprofit partners in the housing space, funders, and other stakeholders to pursue in their work.

Keeping Buildings Affordable for Owners

- Strengthen networks of mutual help and nonprofit support in gentrifying communities.

- Fund more capacity for repair programs.

- Improve access to reliable and reputable contractors by vetting resources like Angi, collaborating with Habitat for Humanity, and building out training programs with the Inner-City Muslim Action Network (IMAN), community colleges, and Workforce Investment and Opportunity Act (WIOA) programs.

- Pair program support with advocating for policy change to maximize impact.

- Work towards reduced property taxes for long-time and lower-income owners, including grandfathering in property tax rates for long-time residents.

- Support phased-in code changes or provide assistance programs to allow long-time owners to afford changes.

- Work towards a reporting system using 311 or smartphones so the city can collect helpful information about what specific challenges with city code or requirements long-time homeowners encounter. Provide a longer grace period with a payment plan to keep families in place.

- Research and address exorbitant insurance hikes at the state level or provide alternatives for long-time owners who cannot afford the new rates.

Keeping Building Ownership or Wealth in the Family

- Increase awareness and guidance of resources and assistance programs.

- Simply getting information to people via resources and in-person workshops from trusted sources like Greater Auburn-Gresham Development Corporation, the University of Chicago, Chicago Bungalow Association, CEDA, Neighborhood Housing Services, the City of Chicago, and Mi Hogar among others can help with keeping people in place. (Next stage: Foundations invest in these programs to expand reach.)

- Foundations investing in programs that help address specific challenges families could face in getting the most value out of the home they inherit.

- Invest in addressing barriers to future planning. More fun community workshops and face-to-face interaction with trusted nonprofits and community centers could provide concrete guidance on different parts of the process and a clear timeline with deadlines. People know they need to plan for the end of life, but struggle to make time for it.

- Test messaging and communication about future planning to activate seniors. Testing key phrases and approaches with trusted partners could improve action planning. Based on what we heard, key phrases that might resonate with seniors are “not enough time,” “not sure where to get started,” “protect their future,” “don’t leave your legacy to chance,” and “how to talk to family members.”

- Better understand the next generation in Englewood. Listen to seniors’ families to learn more about what they need to be able to benefit financially from their family’s long-time investment.

Englewood community members participate in a design session activity with Meegan Dugan Adell from New America Chicago.

Source: Yuliya Panfil/New America

Background

Recruitment

To reach a variety of community members we embraced different methods of outreach. For Englewood, we distributed flyers at community spaces such as public libraries, churches, nonprofits, and co-op grocery stores. We advertised through Craigslist and reached a wide radius through the Chicago Bungalow Association, which ended up being the most successful recruitment strategy.

For both Stay in Place sessions, we had potential participants fill out an intake form answering demographic questions as well as questions about their current living situation and future plans. From there, we followed up with those who seemed to qualify over the phone to build rapport and get to know them better to make sure the session was a good fit for their time. All of those who participated were gifted a prepaid Visa card for their expertise and valuable contribution to the project.

Methodology

Each session was facilitated by a New America staff member. A lead facilitator introduced the team and the purpose of the session, shared how the findings would be used, and offered an opportunity for participants to ask any questions. Each participant was also asked for their consent to record the interview and was provided assurances that everything shared would remain confidential and nothing would be attributed to them by name or any other identifying information. The activities that followed provided multiple ways for residents to participate in a way they could feel comfortable, both verbally in the group and in writing. Sessions were recorded, notes were transcribed, and each session transcript was cleaned for accuracy.

Participant Demographics

The Englewood session had excellent attendance with 17 participants—all African American homeowners over the age of 55 from zip codes 60621, 60636, and 60649.