New Year, New FAFSA - No More

The earlier release of an easier FAFSA is great news for postsecondary students - with one hiccup.

Blog Post

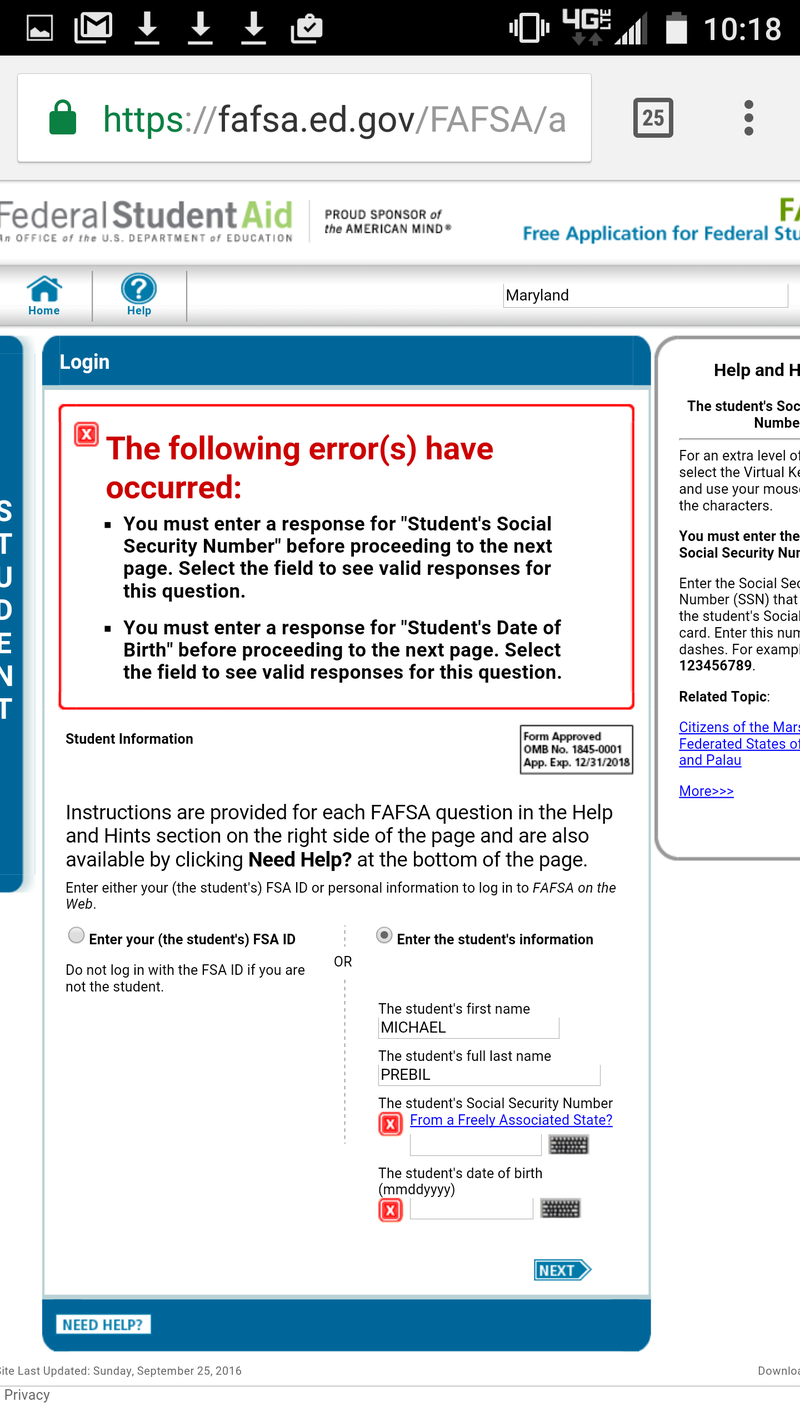

Author's helpless cell phone.

Nov. 1, 2016

In past years, the Free Application for Federal Student Aid (FAFSA) came out on New Year’s Day, and many schools would require its submission just a couple of months after. That meant students and families rushed to finish their taxes in order to file the FAFSA. Last year, the IRS estimated it would receive about 5 million tax filings on the last day of tax season – along with about 13.5 million deadline extension requests. For students applying to and attending schools with a traditional admissions timeline, that wasn’t an option, since financial aid applications are often due by March. This year, luckily, things are little easier for prospective students and families who plan to apply for financial aid.

The relief comes in two forms: an earlier October 1 release date for the FAFSA and the option to use prior-prior year tax information. These changes build on a multi-year effort to demystify the FAFSA by simplifying its skip patterns (students completing online don’t have to worry about filling in info that doesn’t apply to them) and by allowing automatic retrieval of tax data from the IRS. The desired result from policymakers and advocates for all such changes is greater student utilization of financial aid: the harder it is to fill out these forms, the more students are likely to leave them incomplete, to miss out on aid, and to forgo education.

So how much less of a pain is the new FAFSA? I can’t make comparative pronouncements since I last filled one out in 2012, but I think I’m as good a judge as any of the overall experience of the new and improved interface. Along with proposals to further simplify the FAFSA’s questions, a 2015 Gates foundation study advocated a FAFSA that could be completed on a mobile device, since data demonstrate that low-income students tend to use those rather than computers for internet access. That’s a great idea, and as my first step I decided to see if it’s viable for the 2017-8 form.

As it turns out, the FAFSA site is not mobile-optimized yet, but that shouldn’t matter. It does. I couldn’t enter my SSN or my birthday. What does that keyboard icon even mean? It’s for “extra security.” But I can’t use it on my phone. So much for my mobile experiment – it’s the old-fashioned desktop computer way for me.

Start timer! And…stop. Twenty minutes, including IRS data retrieval. That was easy.

Granted, filing as an independent graduate student, I didn’t have to put down any information from my parents, which can be one of the most difficult parts of the process for dependent students, especially if they don’t have easy access to their parent’s data. Also, in spite of my aversion to government forms, I’ve filled out things like this before. I don’t know why I would fill out a Form 1040X, Amended Tax Return - something the FAFSA asked me if I did - but I know for sure that I didn’t. That’s not always the case for new students.

On the whole, the IRS-integrated, October-released, prior-prior year FAFSA is great news for students, though we’ll need to wait and see how well it reaches the estimated 2 million eligible students per year who don’t apply for aid or start their FAFSA but never finish. And, like any transition to a new policy, there will be some bumps during transition. “It’s more work for us,” said the assistant director of financial aid at a Maryland community college, whom I interviewed but who asked not to be named, “and every year it’s something else.”

Schools are still required to verify a proportion of their financial aid applicants through additional documentation – if more students apply, more might need verification, especially if their current financial situation is different than their financial situation reflected on prior-prior year tax returns. And if schools respond by moving up decision schedules or financial aid deadlines, it might cancel out any benefits from this new early FAFSA, and diminish a student’s ability to carefully choose among their options based on price.

A recent EAB survey found 75 percent of enrollment managers expected to adjust their financial aid schedules in light of FAFSA changes, though it appears few have done so yet. Another financial aid officer interviewed on condition of anonymity - the assistant director for counseling at a private four-year college in Washington, DC - said her institution would not change their deadlines, but that she was concerned with effects on the financial aid appeals process. Prior-prior year taxes are useful because most incomes stay stable year-on-year, but of course that’s not always the case, and some students appeal their aid offer if they feel it doesn’t reflect their current circumstances.

These adjustment pains should be expected and are no cause for concern if the end result is greater financial aid utilization. Coordinating the needs of students from different backgrounds pursuing different types of education is a mammoth undertaking, and process refinements in any area are welcome developments. Lamenting federal aid policy’s focus on four-year schools, the community college financial aid officer I interviewed added that “The one-size-fits-all system just doesn’t work.” But alongside other goals like a further simplified form and year-round Pell grant eligibility, an earlier, integrated FAFSA is a good step towards a sized-to-fit financial aid system.